When an employer provides staff housing and acts as a landlord, both employment laws and residential tenancy laws apply. It’s important to understand when each applies, how to manage housing agreements, and what happens when employment ends — especially for seasonal staff.

Yes — in most cases.

In Alberta, the RTA applies to most residential rental situations, including staff accommodation provided by employers — regardless of the length of stay — unless the housing meets one of the specific exemptions listed below:

NOTE: Seasonal staff housing for employment purposes does not fall under these exemptions — even if it's for less than 6 months. In typical hotel staff accommodation scenarios — the RTA applies.

If the RTA applies, hotel employers (as landlords) must comply with:

Other Important Information Covered on this Page:

As a landlord, hotel employers must ensure:

As a landlord:

In Alberta, the Residential Tenancies Act (RTA) primarily protects tenants' privacy and entry rights within their private rental unit. This includes their bedroom, kitchen, or any other area they have exclusive use of. However, shared public spaces in staff housing, like common areas or hallways, are generally not covered by the RTA's privacy and entry protections

Important: Firing or an employee quitting does not automatically terminate their tenancy. Even if the housing is tied to employment, once an employee moves in, they become a tenant under the RTA.

If the Employee Refuses to Leave After Notice:

Download the AHLA's Quick Reference Guide For Notice Periods through TourismWorks (Members Only)

In National Parks communities managed by Parks Canada (like Banff, Jasper, Lake Louise, and Waterton additional federal residency requirements apply to staff housing.

Note: These residency eligibility rules are unique to National Park communities governed by Parks Canada (Banff, Jasper, Lake Louise, Waterton). Elsewhere in Alberta, standard RTA rules apply without these additional eligibility restrictions

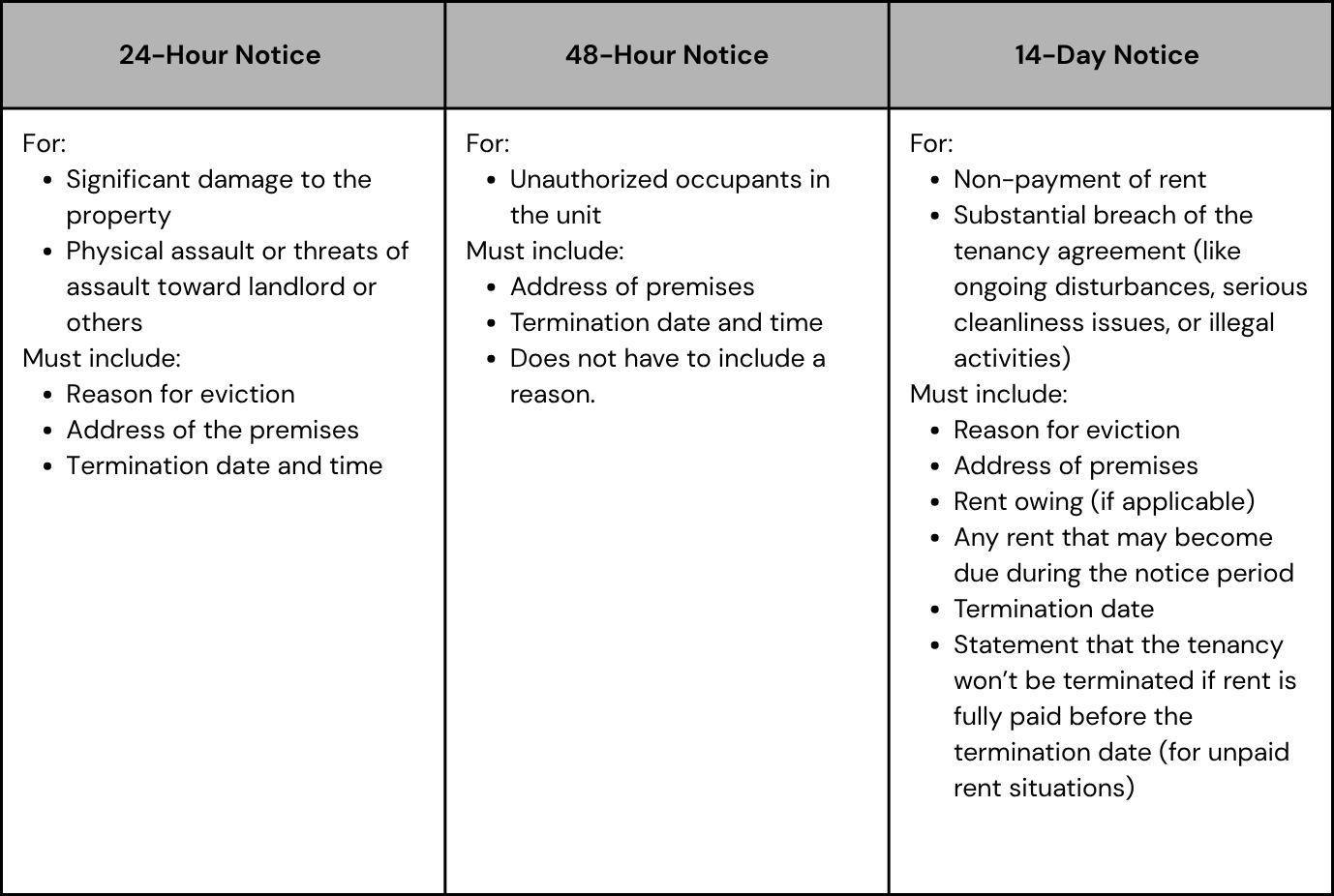

Common Legal Reasons for Eviction:

Download the AHLA's Sample Termination of Tenancy Letter through TourismWorks (Members Only)

Note: Landlords and tenants involved in a dispute can apply for support via the Residential Tenancy Dispute Resolution Service to help resolve their issue

Under Alberta’s Employment Standards Code, employers can deduct for lodging when they provide accommodations to an employee, but only up to a maximum of $4.41 per day.

When Deducting from an Employee’s Pay

Download the AHLA's Sample Payroll Deduction Agreement through TourismWorks (Members Only)

What if the Real Cost is Higher Than $4.41/Day?

If the employer (as landlord) is charging a higher rent than $4.41/day, they cannot deduct the extra amount directly from the employee’s wages. However — the employer still has a couple of legal options:

1. Separate Rental Agreement

2. Avoid Direct Deductions Over the $4.41/Day

A Ministerial Exemption is a special approval granted by the Director of Employment Standards that allows an employer to deduct more than the standard $4.41/day for lodging

When Would an Employer Apply for a Ministerial Exemption for Lodging?

When the actual cost of providing accommodations is significantly higher than $4.41/day (for example, in remote work camps, staff accommodations in high-cost areas, or in hotels offering higher-end staff housing) and:

*Fair market value (FMV) is usually the highest dollar value you can get for your property in an open and unrestricted market, between a willing buyer and a willing seller who are acting independently of each other.

How Does an Employer Apply for One?

1. Submit a Written Application to the Director of Employment Standards The application must include:

2. Wait for Approval

3. Implement as Directed

Example:

A hotel employer in Jasper provides staff accommodation worth $900/month (market rent in Jasper is high). They want to deduct this amount from employees' pay cheques.

Without a ministerial exemption: They can only deduct $4.41/day (≈$132/month) via payroll.

With a ministerial exemption: If approved, they might be authorized to deduct up to the fair market value ($900/month) or a lesser amount deemed reasonable by the Director.

Can You Keep Deducting Rent After Employment Ends?

NOTE: It is very important for an employer who is also the landlord to keep employment obligations separate from landlord obligations.

To learn more about taxable benefits and allowances when providing staff accommodations, click HERE.

Download the AHLA's Sample Staff Housing Agreement through TourismWorks (Members Only)

Tenant Insurance is not mandatory, but strongly advised — for liability, personal belongings, and property damage protection.

The Hospitality Insurance Program, administered by Western Financial Group, can support you.

If staff members are renting or staying in staff housing for more than 30 days, it’s important to ensure they have the appropriate coverage. A tenant’s insurance policy should be in place to provide Tenant’s Legal Liability and Property Coverage for their personal belongings.

For more information, please contact:

In Alberta, staff accommodation should be completely separate from the hotel worksite. Injuries sustained while in staff accommodation would not be covered by WCB unless the worker is working at the time.

Having separate tenant and employment agreements should help clarify that the hotel has two roles, that of landlord and that of employer.

Nuanced Circumstances

There are times when an injury occurs while the employee is on their way to work or on the way back to the staff housing. In this instance, WCB would look at what part of the property the employee was on when the injury occurred. Once a worker reaches an area that a visitor would be in, like the parking lot, then any injury sustained could be accepted by WCB.

WCB recommends that employers have a map of their premises that also outlines the area that would be classified as staff accommodations.

If your summer or seasonal hotel staff are:

The RTA applies.

For summer or temporary staff accommodations:

For more information on topics related to landlords and tenants, contact the Consumer Contact Centre.

Summary

Resources for Hotel Employers

Templates

AHLA members have access to the following downloadable resources through TourismWorks:

Login to your TourismWorks account to download these templates.

The information provided on this webpage is for general informational purposes only and is not intended to constitute legal advice. While we strive to ensure the content is current and accurate, laws and regulations — including the Residential Tenancies Act and Employment Standards Code — are subject to change. Employers who provide staff accommodations or act as landlords are encouraged to seek independent legal advice to address their specific circumstances and obligations. We accept no responsibility or liability for any loss or damages incurred as a result of reliance on the information provided.